Property Tax Leavenworth County Kansas . While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free kansas property. 052 leavenworth county value and tax. Need real estate tax information? The first half is due by december 20th and the second half is due. Total ad valorem tax $128,780,769. Real estate taxes are calculated using the appraiser's valuation of the property as of january 1st and the mill levy for the taxing unit. Search by any combination of these. Search by last name or company name, and/or, tax year. Revenue neutral is defined as when a taxing entity budgets the same amount of property tax revenue or less. Taxpayers have the option of paying personal property taxes in two halves. Today’s approval means riley county.

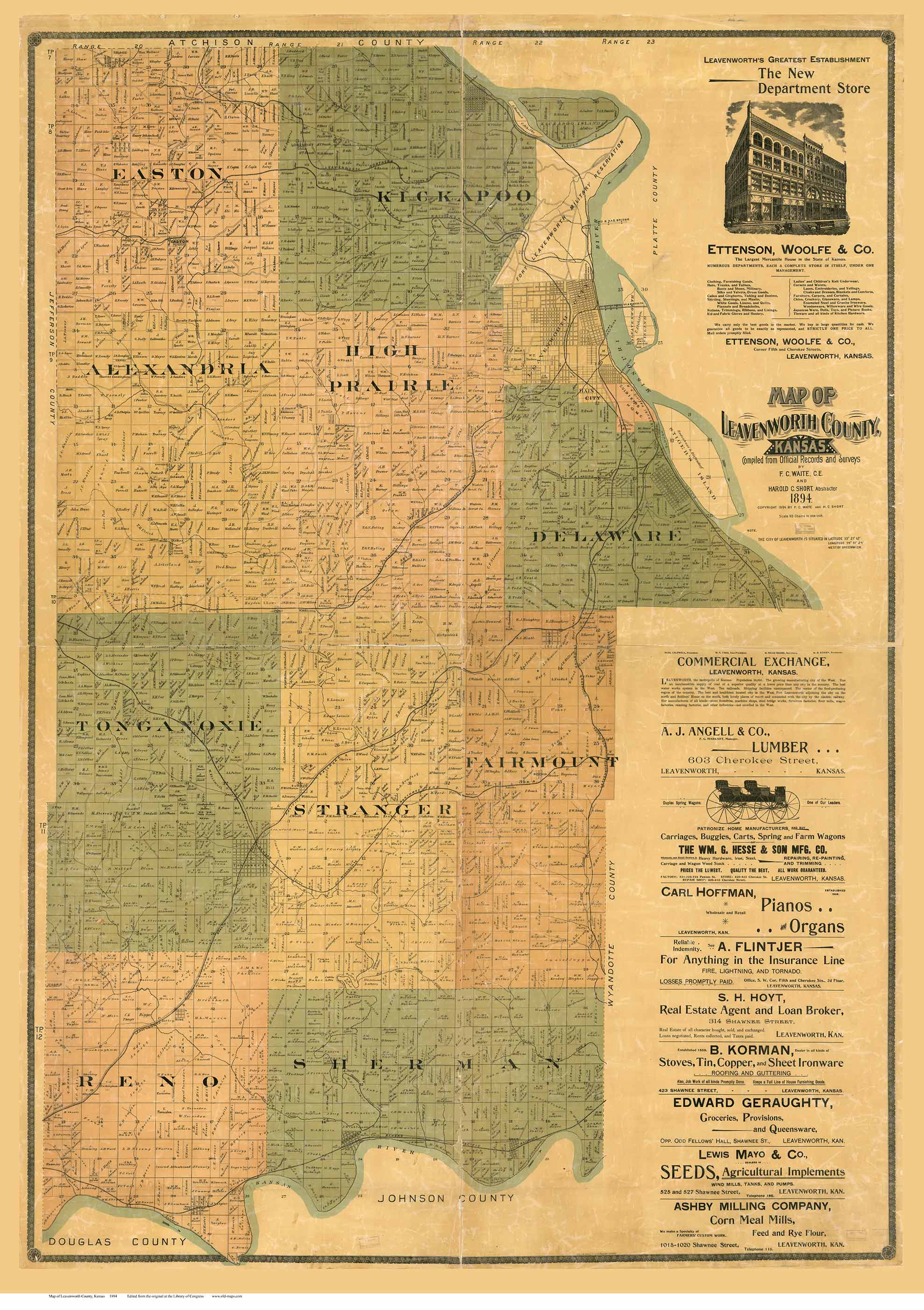

from shop.old-maps.com

Taxpayers have the option of paying personal property taxes in two halves. Real estate taxes are calculated using the appraiser's valuation of the property as of january 1st and the mill levy for the taxing unit. Today’s approval means riley county. Search by any combination of these. Search by last name or company name, and/or, tax year. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free kansas property. The first half is due by december 20th and the second half is due. Revenue neutral is defined as when a taxing entity budgets the same amount of property tax revenue or less. Need real estate tax information? Total ad valorem tax $128,780,769.

Leavenworth County Kansas 1894 Old Map Reprint OLD MAPS

Property Tax Leavenworth County Kansas Search by last name or company name, and/or, tax year. 052 leavenworth county value and tax. Search by any combination of these. Need real estate tax information? Total ad valorem tax $128,780,769. Revenue neutral is defined as when a taxing entity budgets the same amount of property tax revenue or less. Real estate taxes are calculated using the appraiser's valuation of the property as of january 1st and the mill levy for the taxing unit. Search by last name or company name, and/or, tax year. The first half is due by december 20th and the second half is due. Taxpayers have the option of paying personal property taxes in two halves. Today’s approval means riley county. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free kansas property.

From www.niche.com

2019 Best Places to Live in Leavenworth County, KS Niche Property Tax Leavenworth County Kansas Total ad valorem tax $128,780,769. The first half is due by december 20th and the second half is due. Revenue neutral is defined as when a taxing entity budgets the same amount of property tax revenue or less. Today’s approval means riley county. Search by any combination of these. Taxpayers have the option of paying personal property taxes in two. Property Tax Leavenworth County Kansas.

From shop.old-maps.com

Leavenworth County Kansas 1894 Old Map Reprint OLD MAPS Property Tax Leavenworth County Kansas Taxpayers have the option of paying personal property taxes in two halves. Total ad valorem tax $128,780,769. Search by last name or company name, and/or, tax year. Real estate taxes are calculated using the appraiser's valuation of the property as of january 1st and the mill levy for the taxing unit. 052 leavenworth county value and tax. Need real estate. Property Tax Leavenworth County Kansas.

From www.landsat.com

Leavenworth Kansas Street Map 2039000 Property Tax Leavenworth County Kansas Search by any combination of these. 052 leavenworth county value and tax. Today’s approval means riley county. Total ad valorem tax $128,780,769. Taxpayers have the option of paying personal property taxes in two halves. Revenue neutral is defined as when a taxing entity budgets the same amount of property tax revenue or less. The first half is due by december. Property Tax Leavenworth County Kansas.

From mavink.com

Leavenworth Kansas Map Property Tax Leavenworth County Kansas Search by any combination of these. Real estate taxes are calculated using the appraiser's valuation of the property as of january 1st and the mill levy for the taxing unit. Today’s approval means riley county. Revenue neutral is defined as when a taxing entity budgets the same amount of property tax revenue or less. Need real estate tax information? 052. Property Tax Leavenworth County Kansas.

From www.kgs.ku.edu

KGSGeologic MapLeavenworth Property Tax Leavenworth County Kansas Real estate taxes are calculated using the appraiser's valuation of the property as of january 1st and the mill levy for the taxing unit. Search by last name or company name, and/or, tax year. Search by any combination of these. While the exact property tax rate you will pay will vary by county and is set by the local property. Property Tax Leavenworth County Kansas.

From sentinelksmo.org

Leavenworth Co. superintendents reluctant to discuss property tax with Property Tax Leavenworth County Kansas Search by any combination of these. The first half is due by december 20th and the second half is due. Real estate taxes are calculated using the appraiser's valuation of the property as of january 1st and the mill levy for the taxing unit. Total ad valorem tax $128,780,769. 052 leavenworth county value and tax. Today’s approval means riley county.. Property Tax Leavenworth County Kansas.

From sanantoniomap.blogspot.com

Leavenworth County Ks Gis San Antonio Map Property Tax Leavenworth County Kansas The first half is due by december 20th and the second half is due. Revenue neutral is defined as when a taxing entity budgets the same amount of property tax revenue or less. Taxpayers have the option of paying personal property taxes in two halves. 052 leavenworth county value and tax. Real estate taxes are calculated using the appraiser's valuation. Property Tax Leavenworth County Kansas.

From bids.auctionbymayo.com

Leavenworth Kansas Real Estate Auction 3 Properties Land And Property Tax Leavenworth County Kansas Today’s approval means riley county. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free kansas property. Need real estate tax information? Search by any combination of these. Search by last name or company name, and/or, tax year. The first half is due. Property Tax Leavenworth County Kansas.

From www.kshs.org

Leavenworth County, Kansas Kansapedia Kansas Historical Society Property Tax Leavenworth County Kansas 052 leavenworth county value and tax. Today’s approval means riley county. Real estate taxes are calculated using the appraiser's valuation of the property as of january 1st and the mill levy for the taxing unit. Need real estate tax information? While the exact property tax rate you will pay will vary by county and is set by the local property. Property Tax Leavenworth County Kansas.

From www.etsy.com

Leavenworth County Kansas 1894 Old Wall Map Reprint Etsy Property Tax Leavenworth County Kansas Total ad valorem tax $128,780,769. Revenue neutral is defined as when a taxing entity budgets the same amount of property tax revenue or less. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free kansas property. Need real estate tax information? Search by. Property Tax Leavenworth County Kansas.

From www.signnow.com

Kansas Real Estate Contract 20112024 Form Fill Out and Sign Property Tax Leavenworth County Kansas The first half is due by december 20th and the second half is due. Revenue neutral is defined as when a taxing entity budgets the same amount of property tax revenue or less. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free. Property Tax Leavenworth County Kansas.

From www.financestrategists.com

Find the Best Tax Preparation Services in Leavenworth County, KS Property Tax Leavenworth County Kansas Total ad valorem tax $128,780,769. Real estate taxes are calculated using the appraiser's valuation of the property as of january 1st and the mill levy for the taxing unit. The first half is due by december 20th and the second half is due. 052 leavenworth county value and tax. Search by any combination of these. Taxpayers have the option of. Property Tax Leavenworth County Kansas.

From kristyofawn.pages.dev

Leavenworth County Kansas Map Danila Elbertina Property Tax Leavenworth County Kansas Total ad valorem tax $128,780,769. 052 leavenworth county value and tax. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free kansas property. Real estate taxes are calculated using the appraiser's valuation of the property as of january 1st and the mill levy. Property Tax Leavenworth County Kansas.

From www.atlasbig.com

Kansas Leavenworth County Property Tax Leavenworth County Kansas Need real estate tax information? Real estate taxes are calculated using the appraiser's valuation of the property as of january 1st and the mill levy for the taxing unit. Today’s approval means riley county. Search by last name or company name, and/or, tax year. While the exact property tax rate you will pay will vary by county and is set. Property Tax Leavenworth County Kansas.

From www.niche.com

School Districts in Leavenworth County, KS Niche Property Tax Leavenworth County Kansas Revenue neutral is defined as when a taxing entity budgets the same amount of property tax revenue or less. Today’s approval means riley county. Real estate taxes are calculated using the appraiser's valuation of the property as of january 1st and the mill levy for the taxing unit. Need real estate tax information? 052 leavenworth county value and tax. Search. Property Tax Leavenworth County Kansas.

From leavenworth-county-gis-lvcountyks.hub.arcgis.com

Leavenworth County GIS Property Tax Leavenworth County Kansas 052 leavenworth county value and tax. Taxpayers have the option of paying personal property taxes in two halves. Search by any combination of these. Need real estate tax information? Real estate taxes are calculated using the appraiser's valuation of the property as of january 1st and the mill levy for the taxing unit. Total ad valorem tax $128,780,769. The first. Property Tax Leavenworth County Kansas.

From www.countryhomesofamerica.com

3.04 acres in Leavenworth County, Kansas Property Tax Leavenworth County Kansas The first half is due by december 20th and the second half is due. Total ad valorem tax $128,780,769. Today’s approval means riley county. Search by last name or company name, and/or, tax year. Real estate taxes are calculated using the appraiser's valuation of the property as of january 1st and the mill levy for the taxing unit. While the. Property Tax Leavenworth County Kansas.

From www.wichitaliberty.org

Kansas property tax data, the interactive visualization Property Tax Leavenworth County Kansas Need real estate tax information? Today’s approval means riley county. Search by last name or company name, and/or, tax year. Search by any combination of these. Real estate taxes are calculated using the appraiser's valuation of the property as of january 1st and the mill levy for the taxing unit. Revenue neutral is defined as when a taxing entity budgets. Property Tax Leavenworth County Kansas.